19+ llpa mortgage term

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Web Mortgage Regulatory FHFA delays implementation of LLPA DTI fees.

Mortgage Calculator Money

At least one borrower on the loan must be a First-Time Homebuyer AND 2.

. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. LLPA Credits and Explanation of Footnotes Page 8 LLPA Matrix Change Tracking Log Page 9 This Matrix is effective for. Pay at loan origination to lower the amount.

Loan eligibility is determined by the provisions of the Guide. Web For both whole loan and MBS transactions Fannie Mae may apply one or more loan-level price adjustments LLPAs based on certain loan-level credit risk. Prepaid interest that borrowers can.

Web Exhibit 19 Credit Fees Freddie Mac Single-Family SellerServicer Guide Bulletin 2022-22 10312022 Updated 01092023 Page E19-1. Web An amount paid to the lender typically at closing to lower or buy down the interest rate. Get All The Info You Need To Choose a Mortgage Loan.

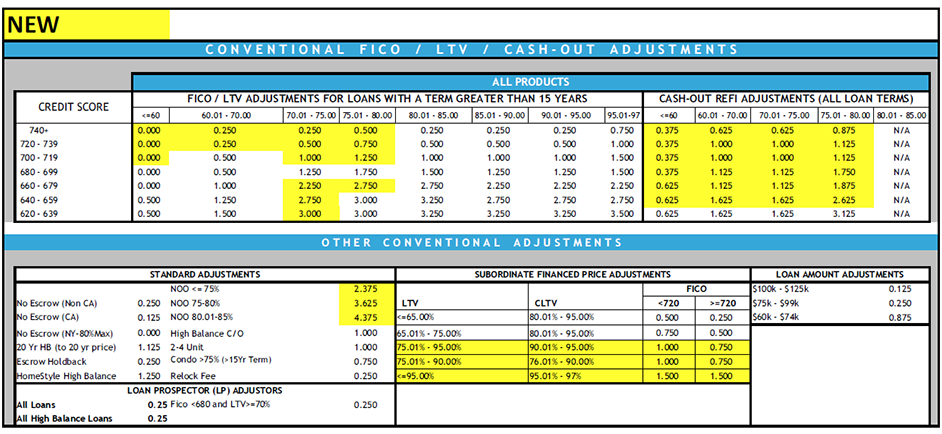

Web Loan-level price adjustments LLPAs are assessed based on certain eligibility or other loan features such as credit score loan purpose occupancy number of units product types etc. Mortgages with Subordinate Financing excluding MCM Page 4 Table. Loan Level Price Adjustments LLPA Representative Credit Score LTV Ratio term greater than 15 years Table 1 Manu factured Home Table 2 Second Home Table 2.

2023 Conforming Loan Limits. Save Real Money Today. TOPICS Mortgage-Backed Securities MBS.

Web Investment property High-balance mortgage loan Condominium Cash-out refinance Table 3. 120 of the AMI for high-cost areas Click here to check for high-cost area. Web For instance if you have a score of 659 and are borrowing 75 of the homes value youll pay a fee equal to 15 of the loan balance whereas youd pay no fee if you had a 780 credit score.

Web Table 6. One discount point equals one percentage point of the loan amount. E-3 Glossary of Fannie.

See links below for more Glossary Terms. Web Loan in Forbearance due to COVID-19_____ Special Feature Code. Web The updated LLPAs will be effective for all whole loans purchased on or after May 1 2023 and for loans delivered into mortgage-backed securities MBS with issue dates on or.

Web The updated LLPAs will be effective for all whole loans purchased on or after May 1 2023 and for loans delivered into mortgage-backed securities MBS with issue dates on or after May 1 2023. Sandra Thompson sets new deadline of Aug. For questions please contact the Fannie Mae Investor Help Line at 1-800-232-6643 Option 3 or by e-mail.

But as of April 1 most borrowers with scores of 740-759 who put less than 20 percent down will pay an upfront LLPA fee of 15 percent of their loan amount up from 025 percent currently. Total Qualifying income is at or below 100 of the AMI for non-high-cost areas OR 3. Web If you want to get a home loan through Fannie Mae but you dont have a lot of cash to use for a down payment a community seconds mortgage could be a great.

For whole loan transactions LLPAs will be deducted from or credited to the loan proceeds. Web First-Time Homebuyers who meet the following are eligible for LLPA Waiver. Web The Exhibit 19 Calculator is not intended to determine whether the loan is eligible for purchase by Freddie Mac.

Web Currently borrowers with FICO credit scores of 740 or above pay little or no fees for LLPAs. Credit Fees for Mortgages with Special. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Web their eligibility for FHA mortgage insurance without the prior approval of HUD. Web Fannie Mae Announces Timing Update for Loan-Level Price Adjustment Framework March 22 2023 Today Fannie Mae published an update to Lender Letter LL. LLPA Waivers Page 7 Table 7.

1 but says post-purchase price adjustments. Choose The Loan That Suits You.

Mortgage Currentcy

Some Big Changes To Mortgage Costs Were Just Announced

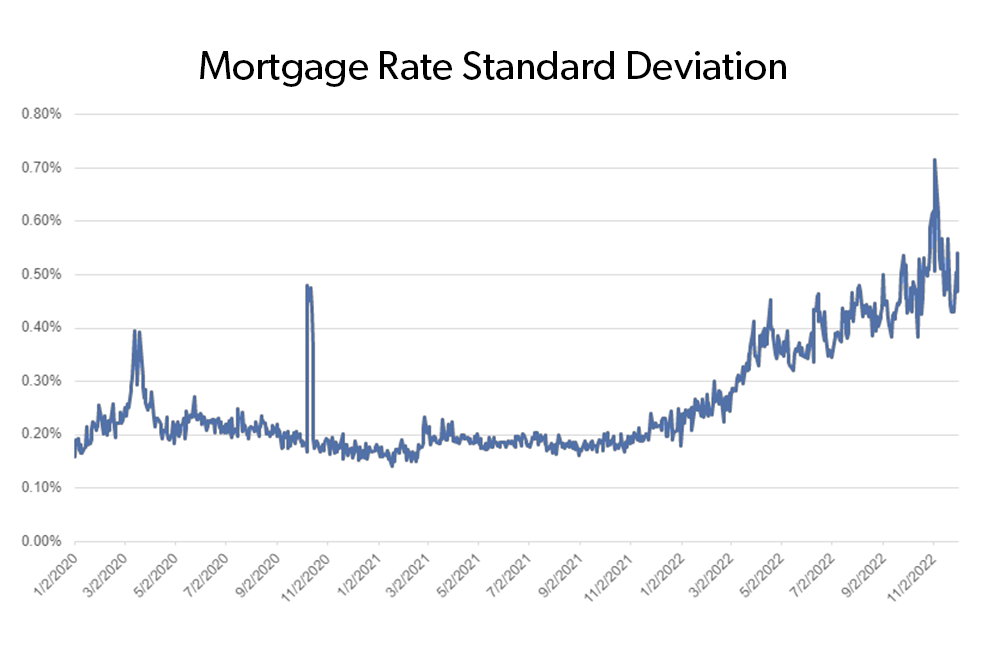

When Rates Are Higher Borrowers Who Shop Around Save More Freddie Mac

Loan Level Price Adjustments Llpa Mortgage Calculator

Mortgage Calculator Money

Loan Level Price Adjustments Explained Green Bay Mortgage Lender

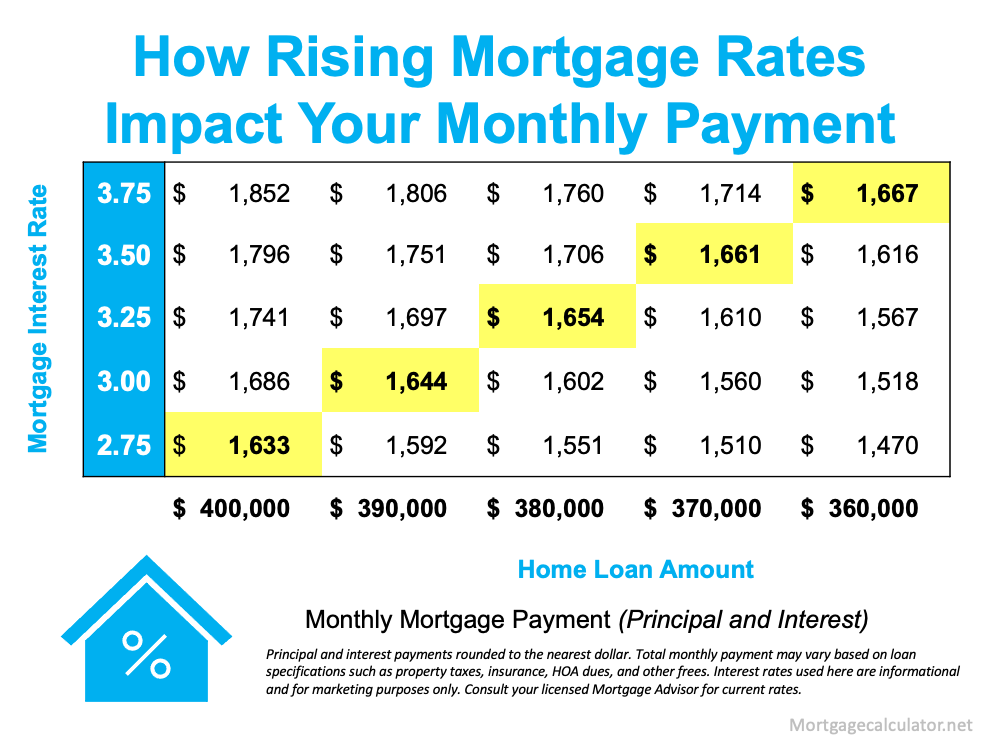

The Best Way To Approach Rising Mortgage Rates

Insight/2020/05.2020/05.13.2020_CoronavirusMortgageUpdate/image3.png)

Covid 19 And The Mortgage Market

Fannie Freddie 2023 Loan Costs Favor Buyers Florida Realtors

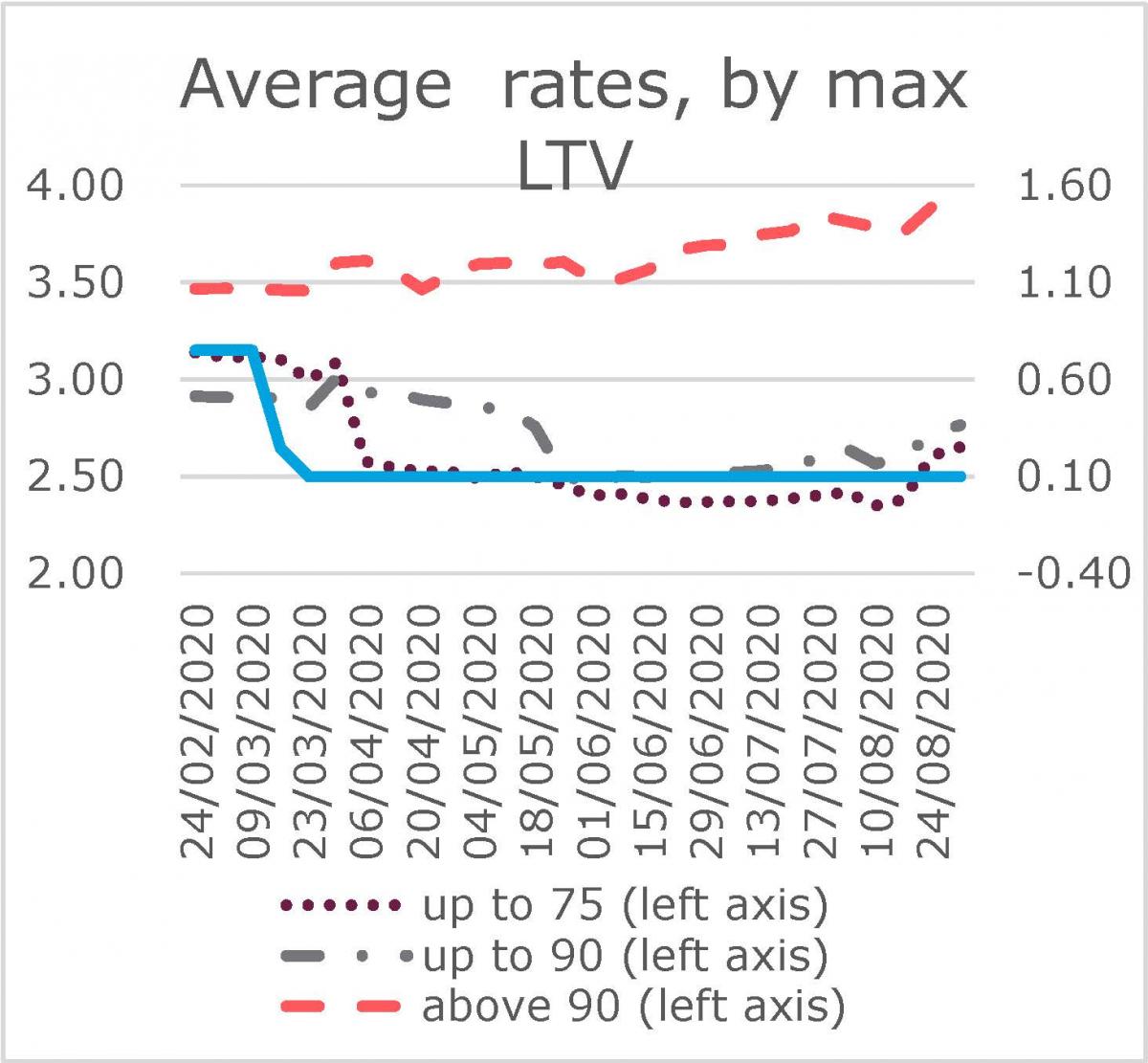

Stay At Home Move House Remortgage Home Loans During The Covid Crisis Fca Insight

Secondary Mortgage Market Definitions Glossary Mct

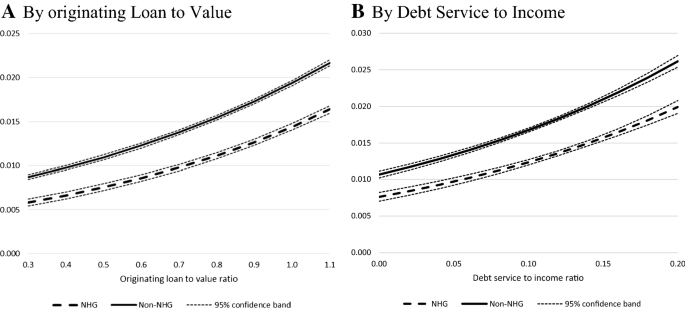

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

Various Dutch Mortgages For Expats Expat Mortgage Platform

Analysing Us Mortgage Rates Data Using Python Youtube

The Mortgage Industry Is Nervous About Llpa Fee Changes

Cole Holmes Waterstone Mortgage

Cost Of Gses Mortgage Market Support May Be Too Steep For Lenders American Banker